what is an

lei number?

A Legal Entity Identifier, or LEI number, is a 20 digit alpha-numeric code which is assigned to regulated legal entities such as Limited Companies, Funds or Trusts.

Once an LEI has been issued by the provider, it is uploaded to the global LEI system (GLEIS) as freely accessible and publicly available reference data.

What is an lei number?

Legal Entity Identifier Definition: A Legal Entity Identifier (LEI), is a code that is unique to a legal entity such as a Limited Company, Fund or trust or any organisational structure.

The LEI code consists of a combination of 20 letters and numbers. This code allows each entity to be identified on a global database of entities searchable by number instead of by name, as many entities may have similar or the same name.

The LEI is an ISO standard, which is now a legal requirement for many companies within the global financial system.

LEI Codes are primarily required by any legal entity who is involved with financial transactions or operating within todays financial system, especially within the US, UK or EU.

The LEI is vital in the global financial system because it enhances transparency, reduces systemic risk, and enables organizations to comply with regulatory requirements.

The LEI is being adopted by regulators and market participants worldwide as the standard for entity identification with over 116 regulations globally.

Often times the LEI identifier system is used in regulatory reporting so that regulators may have an easy way of identifying counterparties to transactions.

The Legal Entity Identifier (LEI) is a 20-character, alpha-numeric code based on the ISO 17442 standard developed by the International Organization for Standardization (ISO). It connects to key reference information that enables clear and unique identification of legal entities participating in financial transactions.

- The Global Legal Entity Identifier Foundation (GLEIF)

LEI format

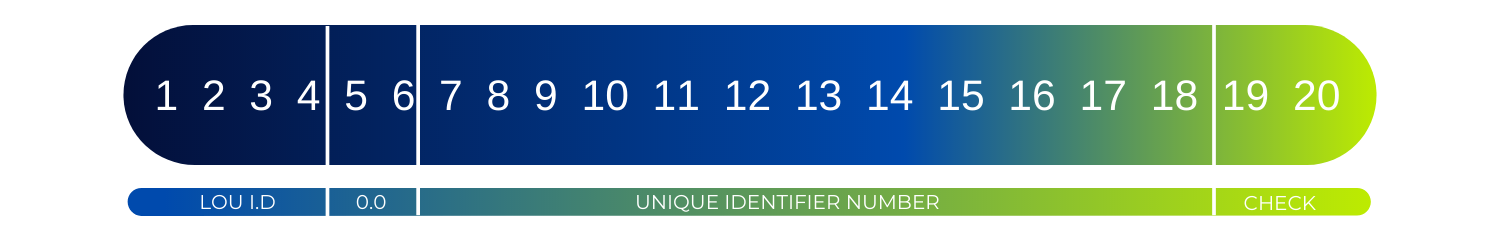

An LEI is a 20-character code that provides a unique, globally recognized identification system for legal entities. The LEI consists of a combination of alpha-numeric characters and includes information about the legal entity's name, registered address, and other details. Please below:

LEI Worldwide is a leading provider of Legal Entity Identifier (LEI) registration, LEI renewal and LEI management services. Our goal is to make it simple and efficient for companies to obtain and maintain LEIs, ensuring compliance, reducing risk and providing greater transparency in the financial ecosystem.

Examples of companies entities that need an LEI are listed below:

- Financial intermediaries (CSDs)

- Banks, investment companies and lenders

- Trading in OTC derivatives (except private individuals)

- SMSF (Self Managed Superannuation Funds) traders and trustees

- Investment Vehicles, mutual funds, hedge funds

- Pension schemes & Commodities trading

- CFDs (Contract for Differences)

- Securities transactions, SFTR reporting & Entities listed on a stock exchange

What is the purpose of an LEI?

The purpose of an LEI, and the lEI system as a whole is to make it easier to identify legal entities on a global scale.

Previously, it was difficult to find out about a counterparty if they had no digital presence. This became problematic in the global financial crisis a decade ago.

The lack of transparency put financial institutions in a vulnerable position as vast numbers of entities and funds were unidentifiable. Also, this created complications relating to risk assessment and transparency.

LEIs help businesses link data sets, improving analysis. Building a complete picture of a business, by linking its data, could also help small businesses to access finance. We will champion the LEI as a globally recognised identifier for all businesses in the UK.

- The Bank of England

What makes an LEI unique?

The LEI is the only global identifier that requires annual renewal, is agnostic to entity type, has sub codes such as the ELF code, and is regulator/central bank backed.

An LEI differs from other identification numbers, such as the Tax Identification Number (TIN) in the US, or the International Securities Identification Number (ISIN), in that it is a unique, non- repeating identifier for legal entities that is used to promote greater transparency in the financial ecosystem.

repeating identifier for legal entities that is used to promote greater transparency in the financial ecosystem.

Unlike TINs or ISINs, LEIs are assigned and managed by a single authority, ensuring global uniqueness and accuracy.

They are also uniquely renewable ensuring up to date data.

Who is the gleif?

The G20 launched the LEI system in 2011, they appointed the GLEIF (Global Legal Entity Identifier Foundation) to oversee the implementation of an LEI system.

Essentially, The Global Legal Entity Identifier Foundation (GLEIF) is a non-profit organization that was established in 2014 to support the implementation and use of Legal Entity Identifiers (LEIs) globally.

Essentially, The Global Legal Entity Identifier Foundation (GLEIF) is a non-profit organization that was established in 2014 to support the implementation and use of Legal Entity Identifiers (LEIs) globally.

GLEIF works to ensure the operational integrity of the Global LEI System (GLEIS) by setting and maintaining technical standards and protocols for the LEI.

GLEIF manages the GLEIS, which is a federated system of partners that are responsible for issuing and maintaining LEIs for legal entities. GLEIF provides a centralized hub that allows data from these partners to be consolidated and made available to the public through its website.

The GLEIF website is a valuable resource for businesses and organizations seeking to obtain or manage LEIs.

The website provides a range of services, including the ability to search for LEIs, check the status of an LEI, and obtain information about LEI issuers.

The GLEIF website also includes information about the LEI standard and technical infrastructure, as well as guidance on how to use LEIs for regulatory compliance and risk management.

LEI USE CASES & APPLICATIONS

The Legal Entity Identifier (LEI) has many uses and applications, including compliance, Know Your Customer (KYC), Anti-Money Laundering (AML), risk management, and more.

LEIs are used by market participants and regulators to identify and monitor legal entities in a consistent and reliable way.

Using an LEI for compliance purposes offers many benefits, including improved transparency, streamlined reporting, and better risk management. LEIs can help to reduce the risk of fraud and financial crime, and can facilitate efficient due diligence processes.

There are several alternative use cases for LEIs, including the validation LEI (vLEI) and the Essential Business Identifier (EBI) for Legal Entities.

The vLEI is a relatively new concept that enables organizations to validate the LEIs of their business partners, while the ELF Code is a simplified version of the LEI that can be used to identify small and medium-sized enterprises in India.

These alternative use cases for LEIs demonstrate the versatility and adaptability of this unique identifier.

how to register an lei code?

Registering for an LEI number involves a few simple steps. First, you need to find a provider that is authorized to issue LEIs. Next, you will need to provide the necessary information about your legal entity, including its name, address, and other details.

There are many providers of LEIs, and their pricing can vary widely. When comparing providers, it is important to consider factors such as the quality of their customer service, their reliability and reputation.

Finally, you will need to pay the registration fee, which can vary depending on the provider. LEI Worldwide offers competitive pricing, with no hidden fees or charges.

STEPS TO REGISTERING AN LEI

- Complete an LEI application form

- Enter all the entity details correctly

- Complete payment at the checkout screen

- Submit and wait for the validation team to issue the LEI

- Receive confirmation via email and LEI uploaded to index

- Download your PDF LEI Certificate

LEI Consolidation and LEI Transfer are two processes that can help organizations to manage their LEI portfolios more efficiently. Consolidation involves combining multiple LEIs into a single portfolio, while transfer involves moving an LEI from one provider to another.

These processes can help organizations to reduce costs and simplify their LEI management processes. Some alternative services that may be required by entities who regularyl use the LEI:

- LEI Registration and renewal

- Reselling and redistribution of LEIs to clients

- Consolidating a fragmented LEI portfolio

- LEI Data Matching & Mapping (ISINs)

- LEI Integration - Whitelabel solution

IS HAVING AN LEI MANDATORY?

While not all legal entities are required to have an LEI, many regulatory regimes and financial market infrastructures now require their use. In the United States, for example, LEIs are mandatory for certain types of financial transactions.

Is an LEI the same as a company registration number?

No, an LEI is not the same as a company registration number. While a company registration number is used to identify a company in the country where it is registered, the LEI is a global identifier that provides a standardized means of identifying legal entities across borders.

In banking and economics, LEIs are used to identify legal entities for regulatory compliance and risk management purposes. They are an essential part of the compliance value chain and are used to support a range of processes, including Know Your Customer (KYC), Anti-Money Laundering (AML), and client onboarding. LEIs are also used in economics to facilitate the tracking of financial transactions and support analysis and research.

In conclusion, the Legal Entity Identifier (LEI) is a crucial part of the global financial ecosystem, providing a unique and standardized means of identifying legal entities across borders. LEIs are used for a variety of purposes, including compliance, risk management, and transaction reporting, and are a key element of the compliance value chain.

The use of LEI code as an identifier is mandated by a number of EU directives such as EMIR , MiFIR, MIFID II, SFTR & CSDR. The United States also have similar requirements such as the Dodd Frank Act, the OFR, the Federal Reserve and the Securities & Exchange commission (SEC) mandate its use in many forms and filing duties.

If you are an organization that engages in financial transactions, it is highly recommended that you obtain an LEI. Doing so can help to streamline your compliance processes, improve transparency and reduce the risk of financial crime.

LEI Worldwide is a trusted and reliable provider of LEI registration services, offering competitive pricing and excellent customer service. However it is up to the individual market participants to obtain their own LEI and ensure it is up to date and renewed annually. That is where LEI Worldwide can help. We can help you to renew an LEI, reactivate a lapsed LEI and transfer an LEI that is with another provider.

Tke the first step towards obtaining an LEI today by visiting LEI Worldwide's website and registering for an LEI. By doing so, you can help to ensure that your organization is compliant with regulatory requirements and can enjoy the many benefits of having a globally recognized identification code.

GLEIF, GLEIS and the LEI (Legal Entity Identifier)

LEIConsolidate - Bulk Transfer LEIs

LEI Costs & Prices

LEI Codes vs ELF Codes

The LEI and the Compliance Value Chain

USA LEI Regulations