Linking the Compliance chain

The Legal Entity Identifier is a 20 digit identifier that is used by regulators globally to create a more transparent marketplace. There are over 116 mandates requiring its use, and all financial transactions that occur within a regulated setting will usually require both counterparties to declare their LEI number.

The LEI database is composed of over 2 million LEI numbers/codes, which is freely available and accessible to anybody. Previously, legal entities could have many various identifiers for a litany of uses and requirements. These are slowly being replaced by the Legal Entity Identifier.

The LEI is global and agnostic to entity type, any formally registered legal entity may obtain an LEI number, making it unique and ideally placed to become a universal common ID across all industries and jurisdictions.

In a global digital marketplace the LEI can act as a ‘master identifier’ which removes the need for previous identifiers, but not replace them. As we can see with ISIN codes (International Securities Identification Number), an LEI record can contain an entities ISIN allowing for multiple data points to verify or validate any particular entity.

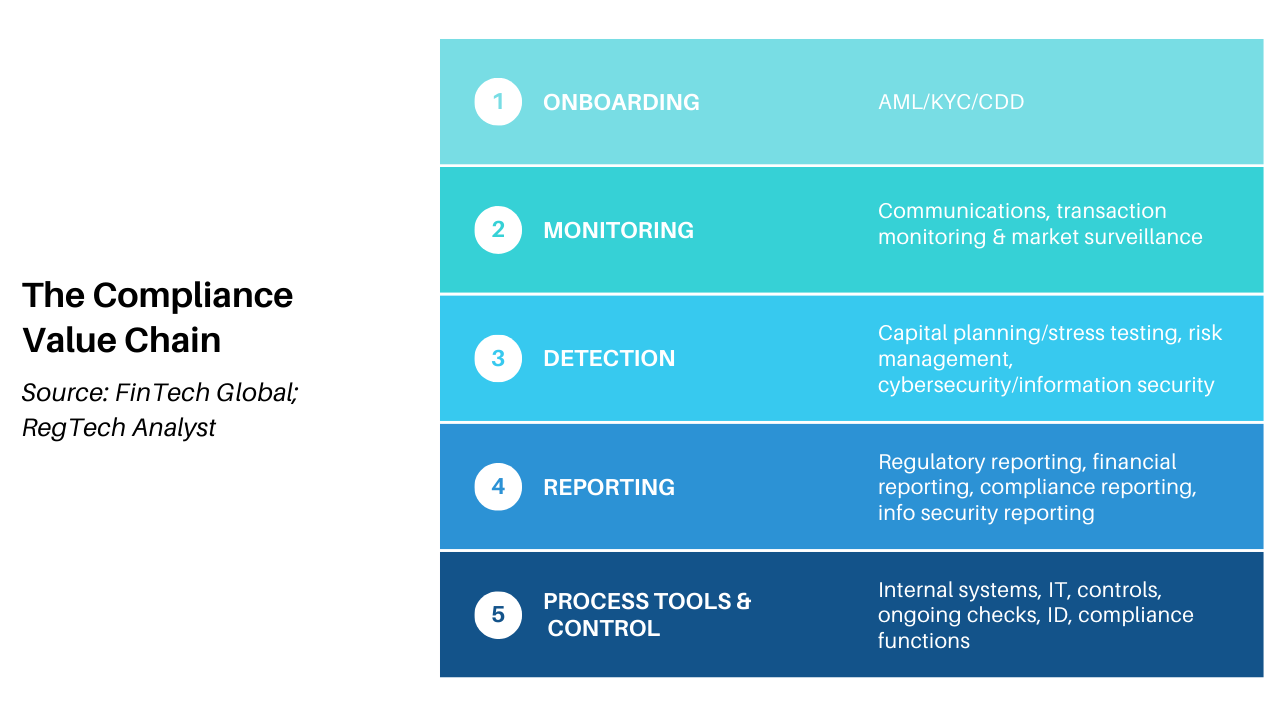

The compliance value chain is made up of 4 primary components.

-

Onboarding: AML, KYC, CDD

-

Monitoring: Communications Monitoring, Transaction monitoring & market surveillance

-

Detection: Capital planning/Stress testing, risk management, cybersecurity

-

Reporting: Regulatory reporting, financial reporting, info security reporting

-

Process tools and controls: Compliance management, internal systems, ongoing background ID checks

If we look at all activities within the wider compliance process as a whole, we can see that the LEI has a positive impact on each component.

The best way to analyze the impact the LEI has on each component is to summarize each one individually.

Where does the LEI FIT?

1. Onboarding: Customer onboarding is essentially the process that new users or clients go through to begin using a new service or product. Customer onboarding is relatively simple for certain industries, however in regulated financial services settings the process of onboarding a new client, such as a bank onboarding a financially regulated vehicle is more complicated. Legal boxes must be checked such as Anti-Money Laundering (AML) checks and Know Your Customer (KYC) checks.

This is known as Due diligence (DD), whereby a reasonable amount of investigation is taken such as verifying the identity of the individual or entity being onboarded. Previously, and in many cases still, due diligence is time consuming, and seen as a laborious ‘must do’ exercise. The Legal Entity Identifier, is streamlining a lot of DD as it is similar to having pre-clearance.

Where an LEI is present, it is guaranteed that the legal entity in question has already undergone many of the identity checks being carried out by the onboarder during the process of obtaining an LEI.

The LEI record will tell the onboarder the legal name of the entity, trading name (if present), the entity type (ltd, LLC, fund, trust etc.), the date of incorporation, in some cases the organisation structure known as Level 2 Data, parent and child legal entities, and soon with the introduction of the GLEIF vLEI, the legal signing authorities of that entity.

If used appropriately this will save financial institutions (FIs) time and resources from having to complete these checks themselves, which can be prone to human error, which we demonstrated in our blog on Inventing Anna and the LEI, and the recent fines received in the UK by Santander for AML breaches.

Recent independent research conducted by McKinsey on the LEI concluded that if the global banking sector were to replace current KYC practices with the LEI, it would save the industry 2-4 billion USD annually.

2. Monitoring: Monitoring in terms of regulatory compliance relates to the internal quality assurance tests that FIs are required to carry out in order to meet the standards set by their regulator and operational obligations.

The LEI can add value to financial transaction monitoring. As the LEI is modern and system agnostic, it can easily be integrated with existing systems and enhance machine learning functionality. For example, payment messages can include an LEI so the payee and payer can be identified by way of their LEI codes.

This would allow for instant reconciliation of funds for accounting purposes. The LEI could complement the IBAN which is currently used in Europe, however an IBAN only identifies a bank account, rather than the payer. In the UK, the Bank of England are committed to utilising the LEI in this fashion for their CHAPS payment messages, fast-tracked by the recent UK Electronic Trade Documents bill.

Likewise in India, the Reserve Bank of India (RBI) have mandated that any monetary transaction in or out of India above the value of 5 Crore (approx 50 million Euro) will have both counterparties (the payer and the beneficiary) to the transaction identified by way of an active LEI.

Moreover, ISO 20022 is a new ISO standard that is setting the foundations for electronic data interchange between financial institutions in a digital financial landscape, which will modernise legacy systems we have come to know such as SWIFT.

GLEIF have become a member of ISO 20022 and recently published a White Paper outlining the benefits of the LEI to ISO 20022 payment messages.

“LEI provides improvements across numerous use cases, this paper provides an overview of how the LEI can be used in the Sanctions screening space (with even more potential improvements once the regulators come on board and add the LEI into the sanctions screening lists) reducing fraud for Corporate Treasurers, account to account owner validation and also improvements across the industry for Know your Customer (KYC) processes.”

GLEIF White Paper

ADDING VALUE EVERYWHERE

3. Detection: The Legal Entity Identifier acts a risk management tool as it provides FIs, regulators and Governments with rich, live data on “who is who” within their respective marketplaces.

The Financial Stability Board (FSB) has massively supported global adoption of the LEI, one of the primary reasons is its ability to reduce inherent risk as well as assessment of micro and macro prudential risks.

The European Systemic Risk Board (ESRB) published a paper “The benefits of the Legal Entity Identifier for monitoring systemic risk”.

Within the global wider economy there exists a degree of clandestine interconnectedness between legal entities, their types, relationships and structures.

These relationships need to be tracked and monitored to ensure financial stability and transparency. The LEI accomplishes this by providing rich data on “who is who” and “who belongs to whom”.

4. Reporting: The LEI is mandated by more than 116 regulations globally. Usually a regulated entity will submit monthly or quarterly activity reports to their regulator, and within those reports an LEI will be furnished for ID purposed or else the reportee will face a “No LEI, No Trade” ruling.

Regulations where this is commonly used include MiFID 2, EMIR, Solvency 2 Directive, AIFMD and US security laws. You can find our more about the regulatory use of the LEI here. Each jurisdiction has its own set of regulations, securities markets and finance laws, for example in the United States the LEI is required under a multitude of regulations.

Including the LEI within a regulatory report allows regulators have one easy to find, common identifier for all entities mentioned within that report. See a recent 2022 update of LEI reporting policies here.

5. Process Tools & Controls: The LEI is also being adopted voluntarily by many organisations such as digital marketplaces, B2B service providers for onboarding and internal system improvement purposes.

Companies with a large organisations with complex structures, firms with SPVs such as the aircraft leasing sector, or shipping, have a large number of entities and the LEI is a simple way to streamline their identification process as it is global, entity type agnostic and can easily be implemented in existing systems.

This can help organise and structure internal entity ID systems while also ensuring there is no LEI related compliance gaps within the overall organisations structure.

----

The above components of the compliance value chain are each touched by the LEI.

The Legal Entity Identifier provides value across the entire spectrum of global digital identity, not just for regulators or market 'watch dogs', but also for private companies with an international presence and lots of clients/entities within their ecosystem that would greatly benefit from having a ‘master identifier’ that is system adaptable, regulator approved and completely free to use!

Find out how to navigate the free LEI search tool here!

GLEIF, GLEIS and the LEI (Legal Entity Identifier)

What is an LEI?

LEIConsolidate - Bulk Transfer LEIs

LEI Costs & Prices

LEI Codes vs ELF Codes

USA LEI Regulations