All about legal entity identifier (lei)

Who needs to have a legal entity identifier?

If you are transacting in capital markets or in a regulated financial services environment you are likely required to have obtained an LEI Code. There are over 116 regulations globally mandating the use of the LEI for transparent markets.

Since the LEI was introduced, there have been many regulations that require certain organisations to obtain an LEI code across different jurisdictions and industries both municipally and commercially.

Why is there a need for the lei?

In order to answer who needs a Legal Entity Identifier, first we must answer, why there is a need for the LEI in the first place.

There has been a global need for an identifier such as the LEI for decades. As global trade increased at an exponential rate in the 1900's, a need arose for transparency in transactions, a means of increasing trust in who you are dealing with, especially cross boarders.There was no common identifier applicable to all legal entities across various industries, from companies, to funds and even Governments. This is why LEI codes are required.

When capital markets and banking went digital, the need for a common identifier rose again. This caused a lot of hassle with regards to identity in regulating the corporate world and financial markets. Companies owned companies that were owned by other companies and it caused a lot of confusion around who owned who, and it made it very hard in some cases to find out who you exactly were dealing with. This was the cause for many famous fraud cases and made it easy to disguise 'dirty' money between organisations.

This also made it difficult for banks and other institutions to onboard new clients as KYC practices were relying on old and unconsolidated data.

Registry information can be hard to access and needed to be collected into a single database. Lacking a reliable, trustworthy identifier it could become laborious and costly to onboard new clients and confirm identity (it is now estimated in research conducted by McKinsey that the LEI could save banks up to 2-4 billion Dollars annually in KYC processes).

History of the LEI: Following the 2008 market crash, issue with transparency in the markets caused a litany of issues with regard to identifying counter parties in transactions. When the stock market crashed, thousands of funds and trusts were unidentifiable and the fall resulted caused mass confusion. The lack of transparency put financial institutions and banks in a vulnerable position.

This was addressed at the G20 Summit of June 2011, who created the concept of the LEI. The idea was to create a digital database, of all legal entities which was easily accessible, reliable and up to date. This database can be found in the LEI Search Tool we have provided.

What is an LEI number used for? LEI Codes are simply identify legal entities on a global scale. This allows for great transparency in financial markets, standardisation, and greater risk control.

According to LEI ROC the LEI no. was conceived to be used by the private sector to support improved risk management, increased operational efficiency, more accurate calculation of exposures, and other needs.

One centralised source of information, that contains vast amounts of attainable, high quality data.

We have illistrated the need for having a global LEI system in our post "Anna Delvey and the LEI".

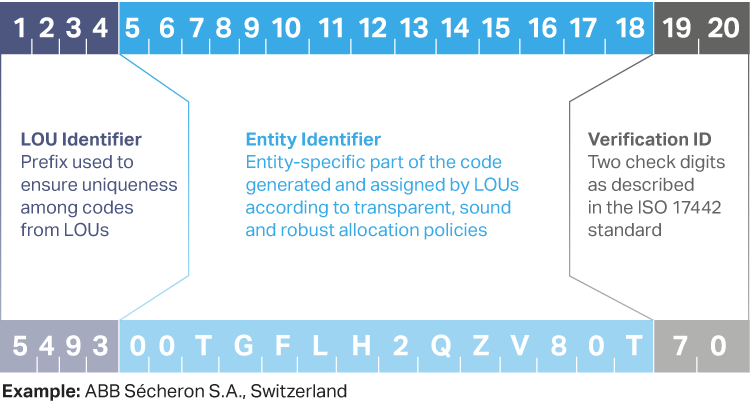

LEI Structure

LEI Structure

Who needs an lei code?

You may be asking do I need an LEI? But you should also ask, who can get a Legal Entity Identifier? Any entity that is considered a legal entity may complete a Legal Entity Identifier application.

A Limited Company, an association, a trust, a charity anything that is recognised by law to be an organisation. However, in order to enhance transparency in the global marketplace some forms of legal entities fall under the mandatory LEI number requirement (Legal Entity Identifier). The LEI requirement is a feature in many EU and Global regulations such as MiFID 2 & SFTR.

LEI Codes are primarily required by any legal entity who is involved with financial transactions or operating within todays financial system, especially within the US, UK or EU. There are a number of mandates currently in existence which state "no LEI, no trade". This means if you do not have an LEI number when required, your trades will be blocked.

Often times the LEI system is used in regulatory reporting so that regulators may easily identify counterparties to transactions.

(LEI) applicable to legal entities, which include, but not limited to, unique parties that are legally or financially responsible for the performance of financial transactions or have the legal right in their jurisdiction to enter independently into legal contracts, regardless of whether they are incorporated or constituted in some other way (e.g. trust, partnership, contractual). It includes governmental organizations, supranationals and individuals when acting in a business capacity[1], but excludes natural persons.

- The International Standardisation Organisation (ISO)

Is the LEI Number mandatory? Examples of companies that have mandatory LEI requirements, are all financial intermediaries, funds and trusts, banking institutions and financial institutions, any legal entity that is listed on a stock exchange or that issues debt, securities or equity. The RBI in India have mandated that any transaction occuring above R50 Crore both parties will need to show an LEI is registered.

Do I need a Legal Entity Identifier? LEI codes are required if your legal entity falls into (but not limited to) one of the following classifications:

- Financial intermediaries (CSDs)

- Banks, investment companies and lenders

- Trade OTC derivatives (except private individuals)

- SMSF (Self Managed Superannuation Funds) traders and trustees

- Investment Vehicles, mutual funds, hedge funds

- Pension schemes & Commodities trading

- CFDs (Contract for Differences)

- Securities transactions, SFTR reporting & Entities listed on a stock exchange

- Pension schemes

The use of the Legal Entity Identifier is mandatory for some companies, but others that may still apply for an LEI when not required are charities, government bodies, associations, and branches. This is quite popular as there are plenty of benefits associated with getting an LEI Number. If you fall under the LEI regulation requirement, but have not yet obtained an LEI, you may be at risk of complications with your regulators, financial intermediary or bank and could face a "no LEI no trade" ruling or a blocked/delayed transaction.

The use of LEI code as an identifier is mandated by a number of EU directives such as EMIR , MiFIR, MIFID II, SFTR & CSDR. The United States also have similar requirements such as the Dodd Frank Act, the OFR, the Federal Reserve and the Securities & Exchange commission (SEC) mandate its use in many forms and filing duties.

LEI requirements vary depending on the country, legal jurisdiction or industry. It is the prerogative of the authorities acting in individual jurisdictions to mandate the use of LEIs.

However it is up to the individual market participants to obtain their own LEI and ensure it is up to date and renewed annually. That is where LEI Worldwide can help. We can help you to renew an LEI, reactivate a lapsed LEI and transfer an LEI that is with another provider.

To find out if you need to have an LEI you can see this attachment which provides an overview of the official current and proposed regulatory activities which include the use of the LEI. If you have discovered that you require an LEI number for trading purposes then you can find out how to apply for an LEI Code here and you can see the documents that are required for obtaining an LEI here.