The LEI is key to unlocking corporate digital identity

We live in an increasingly digital age, digital processes and transactions effect, influence and monitor us on a daily basis. We use digital devices to communicate, transact, authenticate, visualise and record with devices located globally via the Internet.

All of this occurs with limited thought or consideration, except perhaps the authentication of our identity. Our social standing and the media we create can provide an online identity for us but this has proven or be vulnerable to misrepresentation or straight up fraud.

A proven identity is definitely something we value as we know the implications of having an identity that is considered to be proven. In order to obtain a National ID or passport, one must pass certain validity checks and when a passport is presented we can be confident this person is who they say they are.

Currently for a financial institution, identifying a new user digitally, quickly and correctly is a time consuming process with potential risks. Current KYC methods are considered time consuming, clunky and out dated.

Currently for a financial institution, identifying a new user digitally, quickly and correctly is a time consuming process with potential risks. Current KYC methods are considered time consuming, clunky and out dated.

This is important for all of us but it is VITAL in business as organisations and investors need to verify their transactions for legal, security and regulatory purposes.

But why is this an issue you say, if you lost your password for instagram or your email, you can authenticate using 2fa or your back up email or send a code to authenticate you via mobile phone.

So already your provider of whatever you are using online, needs to identify you and authenticate you in some way as the account holder.

You understand this and you comply or you know that you will not gain access. Therefore digital identity is already everywhere and we use it everyday.

Big Tech firms have identification requirements for all of us, but the issue is when it comes to identifying a business there is no common settled upon global standard, no one access ID, or rule that governs all.

The technology is available but it's not seamless across platforms yet... so we are in a state of identity segregation.

The biggest hurdles seem to be adoption rates and trust.

A Global Solution to business IDs: Global LEI System

The solution was created after the financial crisis in 2008 when firms and regulators had difficulty tracing and establishing participants in financial transactions in organisations such as AIG and Bear Stearns.

The SOLUTION is called the LEI - Legal Entity Identifier.

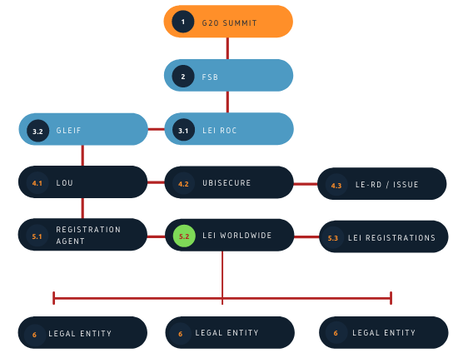

Known as the Global LEI System (GLEIS) which has a governance framework in place recognised by the G20 forum which contains the major economies from around the Globe.

The LEI is:

• 20-digit, alpha-numeric code based on the ISO 17442 standard.

• Designed to be used and recognised globally.

• Identifier for legal entities involved in digital transactions.

• Decentralized and used in an open data system that allows its identification data to be accessed by anyone.

• Incorporates in-depth validation services in each part of its process.

The LEI has a crucial role to play in today's digital world through its ability to provide businesses with unique, permanent identification world-wide for legal identities.

With its origins stemming from the G20 Nations, the LEI system works in the structure on the right hand side.

This ecosystem is capable of providing an LEI identifier to every registered business in the world. With unmatched data quality standards, global reach and uniformity, the LEI is the perfect identifier for global business into the future.

Digital Change

The digitisation of all kinds of personal and organizational activities has accelerated, driven in no small part by the pandemic and the pace of technological change required.

This digital transformation has enabled new business approaches, created new businesses and redefined how organizations connect and engage with one another.

As a result more processes and interactions are also making the switch to digital, and stakeholders are having to work harder than ever to classify, identify and verify their businesses.

As a result, digital identity management has never been more important for business and is vital for their future to perform on a global level.

Businesses without efficient and validated digital identity management encounter business costs in labour and time. This is without mentioning the risk of bad customer interactions, fraud and incorrect data leading to unforeseen costs.

McKinsey have conducted independent research and concluded global adoption of the LEI system would save the global banking sector between $2-4 billion annually.

Why the LEI Code is the Digital Identity Future for Business

Today, different digital ID systems are based on varying certification and technological standards, keys and encryption and the only common link between them is the entity name, which can vary widely and as mentioned can change over time.

The LEI is the solution as it provides the ability to rethink customer relationships by having an inbuilt trust solution that is verified enabling determination of who’s who removing related costs and inconvenience and pure frustration of manual processing.

A universal solution that provides a unique id that does not require the stakeholder to be locked in and can be easily updated.

An LEI provides:

• Regulatory endorsement

• Standardisation

• Recognised legal identifier

• Based on open data

As LEI’s are used currently in the public and private sectors, in the digital age its proven to be of great value for regulation and business.

The system is already is improving customer onboarding, communication and verification and this is only the start of its use.

LEI can provide a fast and simple way to ensure the information obtained through digital certificates is suitably reliable, current and verifiable.

The LEI can become an essential building block for the usage of digital certificates and digital signatures.

Quarter 2: 2021

The Global Legal Entity Identifier Foundation (GLEIF) welcomed the first commercial demonstration of LEIs embedded within digital certificates by the China Financial Certification Authority (CFCA).

Stephan Wolf, CEO of GLEIF commented:

This progress by CFCA on both fronts is very welcome as it moves us one step closer to broad LEI usage in digital certificates globally. Realizing the goal of universal LEI usage in digital identity products will be an important step in enhancing trust and creating innovation opportunities across private sector digital identity management applications.

Digital certificates linked by an LEI to verified, regularly updated and freely available entity reference data held within the Global LEI System are easier to manage, aggregate and maintain.

The result will be significant efficiencies and far less complexity for certificate owners and the provision of greater transparency for all users of the internet and participants within digital exchanges."

LEI being an ISO 17442 standard, linking back to a datafile in GLEIF that is publicly available answers the question who is who and who owns whom for ALL stakeholders NOW and in the FUTURE.

Establishing your legal identity digitally and it being trustworthy has become a foundational requirement for digital life to enable the determination of 'who's who' within any digital community to validate interactions of any kind social, financial or business.

The VITAL role to be played by Digital identity and the LEI in the future of global business cannot be overstated.

Inventing Anna and the LEI System